SaaStrSummit New New in Venture – Top 5 Takeaways

With face to face gatherings no longer an option, sharing knowledge through online conferences is the new normal. Luckily, the SaaStr team brought together some of the most knowledgeable individuals in the IR industry to SaaStr Summit: New in Venture. Let’s explore our top 5 takeaways, highlights, and share our opinion of which speakers left the greatest impact!

With face to face gatherings no longer an option, sharing knowledge through online conferences is the new normal. Luckily, the SaaStr team brought together some of the most knowledgeable individuals in the IR industry to SaaStr Summit: New in Venture. Let’s explore our top 5 takeaways, highlights, and share our opinion of which speakers left the greatest impact!

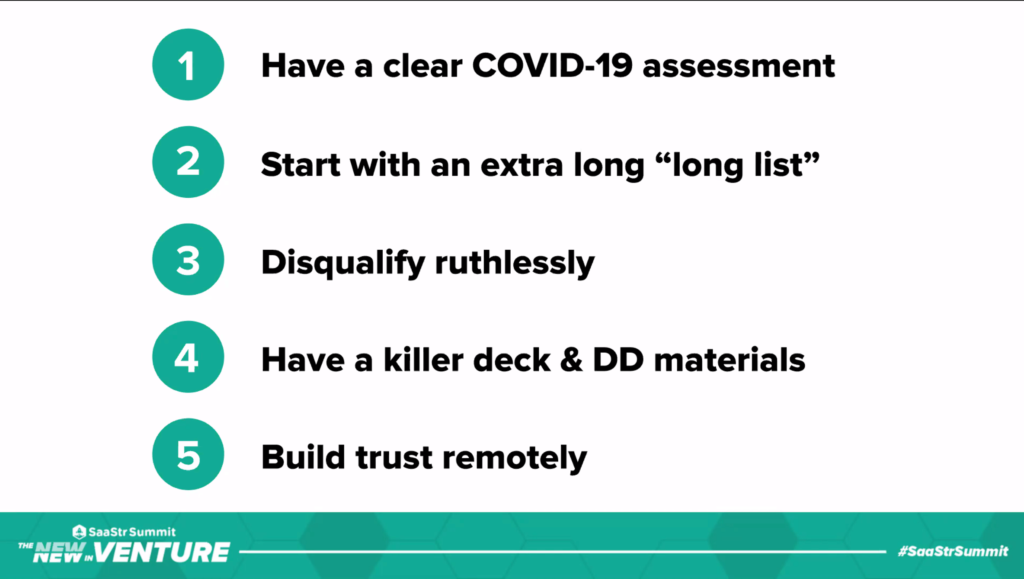

New in Venture: Fundraising During a Pandemic with Christophe Janz

Kicking thighs off with one of the first sessions of the day featured Christoph Janz, discussing how to effectively fundraise during a pandemic. He presents 5 actions that a company should take to make itself appealing to investors.

1 – Have a Clear Covid-19 Assessment

In the current age, it’s important to have clear messaging around your response to the pandemic. You should clearly state how your team is doing if you reduced your target revenues, and whether or not the work-from-home situation has changed the way you hire.

2 – Start with an Extra Long Longlist

Christoph states two main reasons for doing this. The first is because you may have to, many investors are more cautious and busier with their portfolio making the bar to meet with them higher. Firms may drop out of the process if they aren’t able to build conviction without meeting you in person. The second reason for this is because you can. Without traveling, dinners, etc, which means you need to have backup plans to meet your goals.

3 – Disqualify Ruthlessly

This mindset is based on the simple fact that more often than not, it’s either love at first sight or just not going to happen. In times like these, you can’t afford to spend time on something that’s never going to happen. Another reason is that you probably don’t want to be the guinea pig that teaches an investor on how to invest remotely.

4 – Have a Killer Deck

You should always strive to have great materials to present but when remote, it’s all the more important. You should create a list of all you’re most important KPIs before you begin pitching so you have answers to all the questions you’re likely to receive.

5 – Build Trust Remotely

Building trust may be the most important. You should be extremely transparent to your investors and very responsive to their replies. Christoph suggests inviting investors into your ChartMogul account or internal dashboard early on so they can see your KPIs for themselves.

New In Venture: What’s Changed & What Hasn’t with Jason Lemkin and Keith Rabois

The second session of the day featured Keith Rabois who shared his years of experience and answered a number of questions many in SaaS have. Some of these questions include his prediction of recovery, the decision-making process as an investor, and the type of benefit a good investor can have on founders. It’s always great to hear from such a seasoned investor and gain a glimpse into his thoughts on the Covid-19 situation.

The Recovery

Keith Rabois has a very insightful answer when asked what he believes the economic recovery will look like. “I think some industries will recover before others and there will be a segmented recovery.” He went on saying that “Some industries may be permanently damaged.” Although many may believe that some industries will recover before others, it was interesting to hear his belief that some will never return to the level they once were. One example he gives is the global tourism industry. He argues we may never return to the times when people travel the world without a care.

Selecting Founders To Fund

A second question Keith discussed was how he decides what type of founders he will invest in. “85% of my decision-making process when investing is based on the skills and attributes of the founding team.” Jason talks about the importance of those involved in the organization as much as the product/service itself. He mentions each investor has preferences that also impact their decisions and some companies may just not fit with the type of organizations they prefer to work with.

The Value of Investors

A final topic he touched on was the value investors can provide. “One of the best things a good investor can do is accurately forecast what you need to look like in the future. Investors have complete visibility into where they need to land with enough time to land there.” An investor has been through the fundraising before and can provide valuable insight into what founders should strive for at each stage.

Hearing from such a knowledgeable investor was definitely a highlight. Similar to Keith, the OpFocus team always takes a prescriptive approach with our clients. We make sure to understand their goals so we can provide expertise to help them be successful.

New In Venture: Adjusting your Sails to Navigate Today’s Choppy Waters with Chris O’Neill

Next up was Chris O’Neill who spoke about How to Navigate Today’s Choppy Waters and Lessons from Previous Downturns and Turnarounds. Throughout his presentation, he likened leading a company to sailing a boat and the current situation to experiencing choppy waters. “In difficult waters, the pessimist complains about the wind, the optimist expects it to change, but a leader adjusts the sails.” Chris goes on to outline a three-step strategy for successfully steering a company out of these difficult times.

Adjust your Sails:

Almost all companies will need to adjust their course of action to emerge from the current situation. He states that it’s important to establish ground truth with your team. Be open with your team about your business situation and where you’re going. Once you understand your ground truth and your north star, you’re ready to plot a course to get from one to another.

Take Care of Your Crew:

Chris brings up an interesting point when he talks about caring for your crew (or team members.) once companies emerge from this crisis, they will once again need to hire, and they won’t want to be known as the company that cut employees excessively. To the best of its ability, this is a chance for companies to show their human side and invest in their people.

Plan for what’s on the horizon:

When planning for the future, you need to understand what the future will look like. Chris suggests that the future founders will take a more audacious approach to societal problems and have a greater fortitude to bounce back when things get tough.

Overall this was one of my favorite sessions as it provided a start to finish look at a plan to move forward out of this crisis. I hope many companies will be able to chart a course and set sail to smoother waters over the coming months.

New In Venture: How Does COVID-19 Change The Future of Work? with Lan Xuezhao

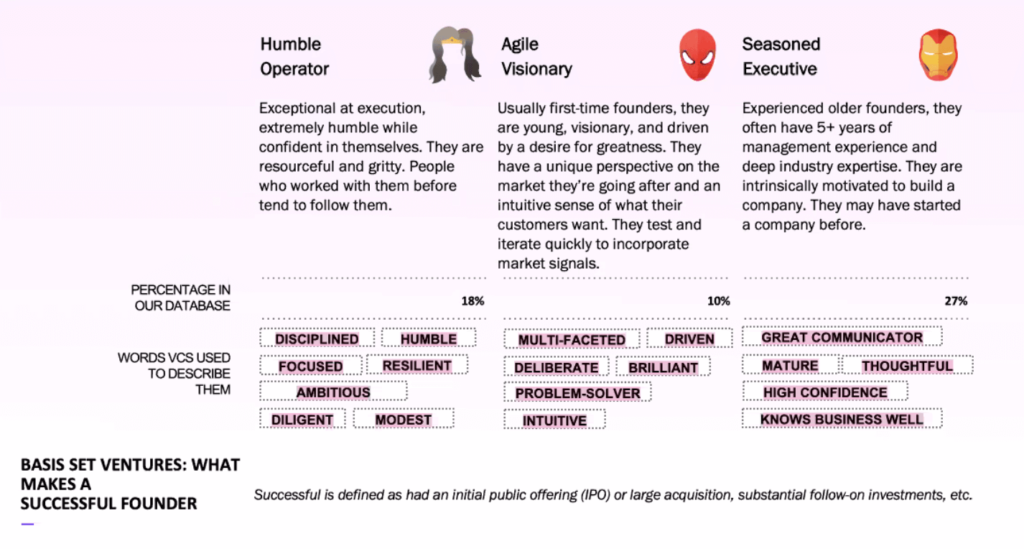

The session by Lan Xuezhao was one of the most interesting as it focused on how Covid-19 impacts different parts of the economy. The three areas that she touched upon were the types of successful funders, how and where we work, and the impact on the supply chain.

A New Type of Leader

In difficult times, it takes a different type of leader to be successful. Through her research, Lan has identified three leader archetypes that are proving to be successful during this time. They include a variety of leadership styles but the one thing that relates them is the ability to pivot and think strategically. Lan has come to the conclusion that resourcefulness and thinking scrappy will be key for this type of “war-time” leadership.

How we work

The second part of the economy impacted is how people work. It is no secret that working from home has become the new normal. This has led many companies to begin favoring a completely decentralized model, some doing away with office locations altogether. there will be a shift in how we work moving forward as the companies and workers become accustomed to this setup.

The Changing Supply Chains

Supply chains are the final area he spoke about. Although once a complex topic that involves interwoven companies and processes; COVID is causing it to become more streamlined. There has been a shift in how products are delivered to the consumer; with many companies embracing a more direct approach. By doing so is beneficial for both the producer of the good and the consumer as there are fewer organizations involved.

The reason this was one of my favorite sessions is because it touched on different aspects of the economy, showing how widespread the impacts can be. Although the have been even more areas that have been affected, this presentation did a great job of diving into some of the largest trends that have emerged.

New In Venture: The Midas List Live with Konrad, Ann Miura-Ko and Nicole Quinn

Two investors, Ann Miura-Ko and Nicole Quinn, discuss the challenges many investors are facing in the final session. One of the biggest challenges that they discussed was finding the right companies to invest n. Right now, it can be difficult to determine what companies will be successful one-two years from now. Some companies are overperforming due to the pandemic and many are struggling.

Nicole mentions that she is a strong believer that habits stick and after the lockdowns, those that people have adopted will continue. She suggests companies consider subscription models if possible, to develop this type of habit in their clients. Nicole goes on to discuss how to her personally, it is ok for a company to not be profitable. If this is the case however, they must know the “4-5 levers to pull to get to profitability” for her to consider them.

Ann discussed her views on how this pandemic will impact leadership. “Leadership is what you do in difficult times, not what you do when you hit the lucky score. You’ll see inspiring examples of leadership in the coming months” It’s exciting to see some good come from the pandemic as we will see the emergence of great leaders with high aspirations. Ann also mentions that she wants companies to see themselves as becoming the next Zoom, this is what she looks for in a company.

Hearing first-hand from these two seasoned investors was the perfect way to end the day. It’s always an honor to hear from people as knowledgeable as Ann and Nicole. Learning about what investors are looking for is extremely valuable!

Final thoughts

Whether you were able to attend SaaStr Summit: New in Venture or are just discovering the insights now, we hope you have walked away with valuable insights. If your team is thinking about becoming more strategic, let’s connect and discuss the type of roadmap we’ve developed for other professionals.